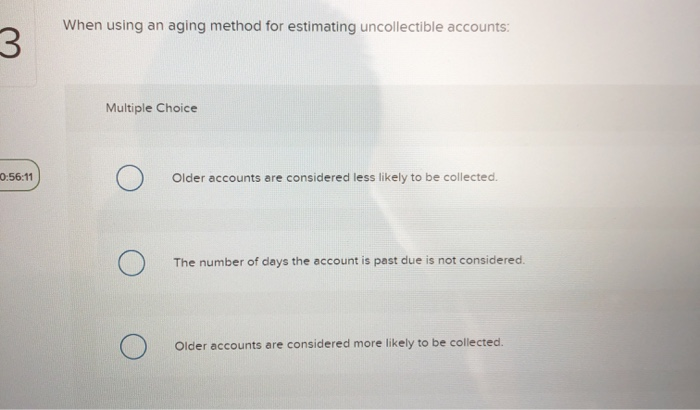

When Using an Aging Method for Estimating Uncollectible Accounts:

27 Using the aging-of-accounts-receivable method to estimate uncollectible receivables CMU Corporation estimates that 3750 of its accounts receivable will be uncollectible. Prior to adjustment the Allowance for Doubtful Accounts has a credit balance of 600.

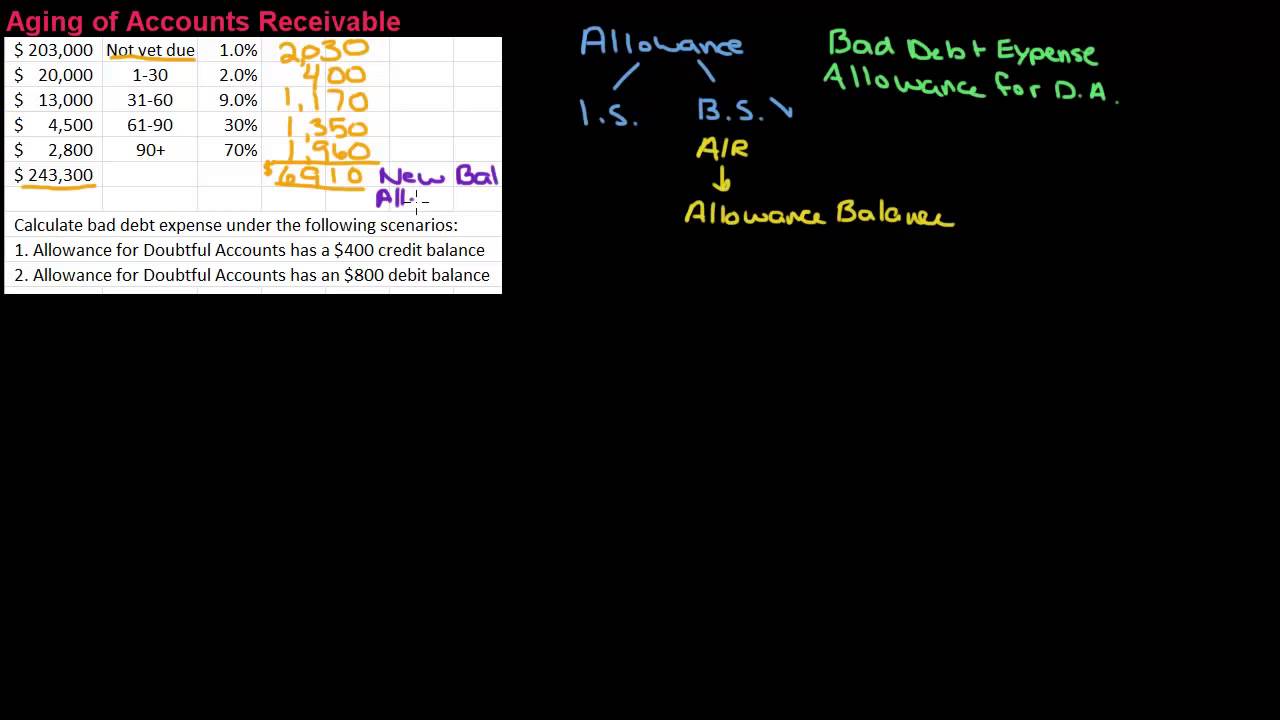

Bad Debt Aging Of Accounts Receivable Method Youtube

When a specific receivables account is deemed to be uncollectible allowance for doubtful accounts is debited and accounts receivable is credited.

. When using an aging method for estimating uncollectible accounts. Under this method the uncollectible accounts expense is recognized on the basis of estimates. This video explains how to estimate bad debt expense using the aging of accounts receivable method.

The amount of bad debt expense can be estimated using the accounts receivable aging method or the percentage sales method. It is likely based on past experience but it is only an estimate. The estimated amount that will not be collected should be the credit balance in the contra asset account Allowance for Doubtful Accounts.

Equity Net Realizable Value of Receivables Ret. Page 332 Aging Accounts Receivable LO 7-3 Use aging of accounts receivable to estimate uncollectible accounts expense. A 4350 B 3750 C 3150 D 600.

The aging lists every customers balance and then sorts each customers balance according to the amount of time since the sales occurred. Is required to be used by all companies because it focuses on what should be the most relevant and faithful representation of accounts receivable on the balance sheet not an. It could have been determined via an aging analysis.

The debit balance in Accounts Receivable minus the credit balance in. An example is provided to illustrate how an aging schedu. Instead the 25500 simply relates to the balance as a whole.

Suppose based on past experience 5 of the accounts receivable balance has been uncollectible and the accounts receivable at the end of the current accounting period is 150000 then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using. Preparing an aging of accounts receivable to identify the potentially uncollectible accounts. B The number of days the account is past due is not considered.

D No estimate of uncollectible accounts is made. Estimating the Bad Debt Expense. Definition of Aging Method.

Bad debt expense to be reported on the income statement is. B Record the bad debt adjusting entry using the information determined in a. The aging method usually refers to the technique for estimating the amount of a companys accounts receivable that will not be collected.

2860 NA 2860 NA 2860. Percentages based on past history are applied to different strata. Accounts receivable aging method.

This is used as an ending balance of allowance for doubtful accounts. Percentage of Accounts Receivable Method Example. There are two general approaches to estimate uncollectible accounts expense.

The first one is known as aging method or balance sheet approach and the second one is known as sales method or income statement approach. The percentage of receivables method or the aging method if that variation is used views the estimated figure of 24000 as the proper total for the allowance for doubtful accounts. Instructions a Complete the aging schedule and calculate the total estimated uncollectible accounts.

The accounts receivable aging method is used to estimate the amount of uncollectable debts which includes the approximate amount of the receivables that may not be collected. The unadjusted balance in Allowance for Doubtful Accounts is a debit of 3000. A Older accounts are considered less likely to be collected.

Balance Sheet Income Statement Assets Liab. A balance sheet approche since it focuses on accounts recette is a variation of the direct write-off method. The aging method is used to estimate the amount of uncollectible accounts receivable.

The aging-of-receivables method of estimating uncollectible accounts is. An aging of accounts receivable stratifies receivables according to how long they have been outstanding. The technique is to sort receivables into time buckets usually of 30 days each and assign a progressively higher percentage of expected defaults to each time bucket.

Allowance for uncollectible accounts 1113 56 Provision for uncollectible accounts during 2013 2 on credit sales of P2000000 40 Uncollectible accounts written off 113013 46 Estimated uncollectible accounts per aging 69 After year-end adjustment the uncollectible accounts expense for 2013 should be. Two common ways of estimating the amount of uncollectible receivables are. Thus the accountant must turn the 3000 debit balance residing in that contra asset account into the proper 24000 credit.

C Older accounts are considered more likely to be collected.

Aging Method For Estimating Uncollectible Accounts Youtube

0 Response to "When Using an Aging Method for Estimating Uncollectible Accounts:"

Post a Comment